Cheapest auto Insurance quotes in Oklahoma- identify the Cheapest auto Insurance quotes in Oklahoma, we get quotes from the largest insurance companies in the state. For the average driver, GEICO offers the cheapest policies, and you can save up to $1,407 per year by comparing offers.

Cheapest auto Insurance quotes in Oklahoma

For most drivers in Oklahoma, GEICO is the most affordable auroinsurance option but other factors like age, credit score, driving history, and coverage amount also impact autp insurance rates.

For instance, if you have a DUI on your record, State Farm is the cheapest option in Oklahoma. USAA is also among the most affordable autpinsurance companies in Oklahoma, but it is only available to current and former members of the military and their families.

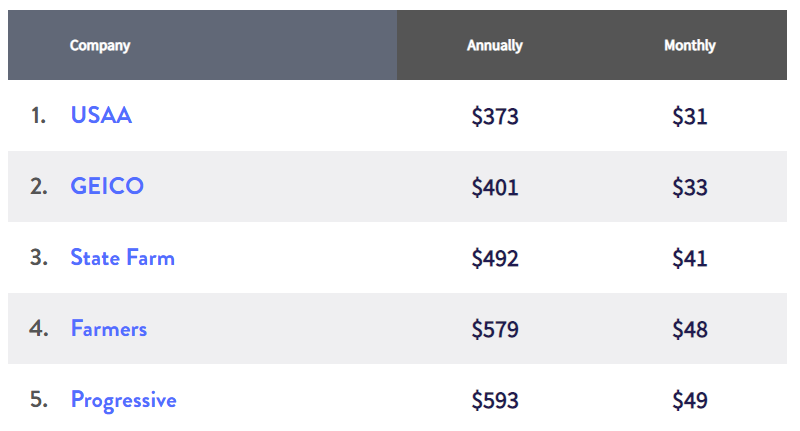

Cheapest Minimum Liability auto Insurance in Oklahoma

Oklahoma drivers looking for the cheapest auto insurance can consider getting minimum liability coverage, which only meets the state requirements.

MoneyGeek evaluated auto insurance companies in Oklahoma and found that the cheapest options for minimum coverage are:

- GEICO: $401 per year

- State Farm: $492 per year

If you or a family member is a current or former military member, you qualify for USAA coverage at an average annual rate of just $373. Based on average rates, MetLife offers the most expensive auto insurance for minimum coverage at $852 per year.

CHEAPEST MINIMUM auto INSURANCE IN OKLAHOMA

These prices are only estimates based on rates for an average Oklahoma driver and should not be used to compare insurance prices.

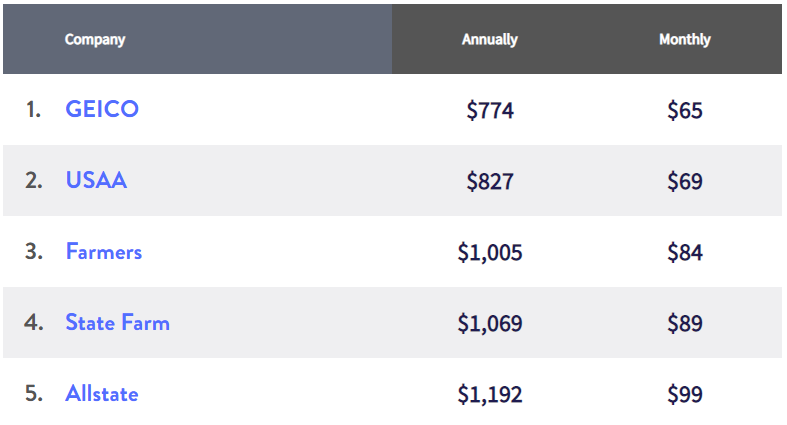

Cheapest Full Coverage auto Insurance in Oklahoma

A full coverage policy in Oklahoma is more expensive, but it comes with higher liability limits and comprehensive and collision insurance. This gives you protection against most road and off-road accidents. Additionally, it also covers damages to your vehicle. Compare rates from different auto insurance companies to find the best deal.

Among auto insurance companies in Oklahoma, the cheapest options for full coverage are:

- GEICO: $774 per year

- Farmers: $1,005 per year

If you’re part of a military family, you can get coverage from USAA for the competitive rate of $827 per year on average. MetLife offers the most expensive auto insurance for full coverage, with an average annual rate costing $2,181.

CHEAPEST FULL COVERAGE auto INSURANCE IN OKLAHOMA

These prices are based on a policy with comprehensive and collision insurance that allows you to claim up to $100,000 for bodily injury per person, $300,000 for bodily injury per accident and $100,000 for property damage per accident. Your individual premiums will be based on your circumstances and will be different than the examples given.

How to Compare Cheap Oklahoma auto Insurance Quotes Online

Most auto insurance companies in Oklahoma allow drivers to get a reasonably accurate quote on their website.

- Determine the amount of coverage you will need before shopping. Then, if you ask one insurance provider for a quote for a policy with $300,000 in bodily liability insurance per accident, use the same number when you compare quotes with other insurers.

- Based on average rates in Oklahoma, the most affordable companies are GEICO and State Farm. You can begin your search for an insurance policy by getting personalized quotes from these companies.

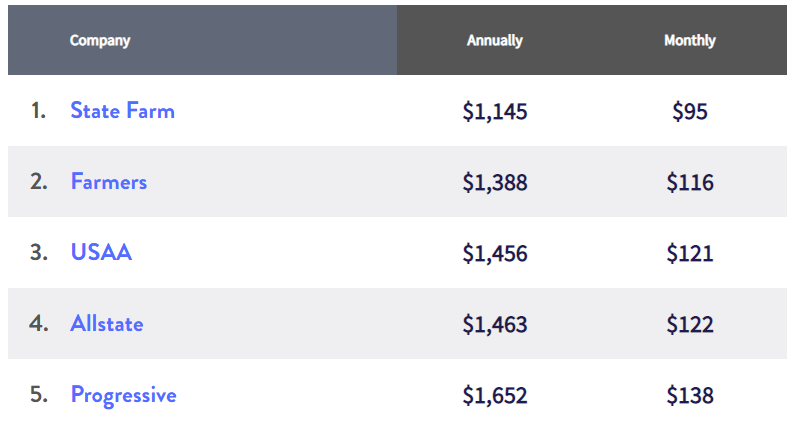

Cheapest auto Insurance for Drivers With a DUI in Oklahoma

If you have a serious violation in your driving history, such as a DUI, insurers will charge you higher rates. In Oklahoma, drivers with a DUI pay an average of $2,025 per year. Those who have clean records pay an average of $1,299 per year.

The auto insurance companies offering the cheapest options for drivers with a DUI and full coverage in Oklahoma are:

- State Farm: $1,145 per year

- Farmers: $1,388 per year

In comparison, GEICO and USAA are the most affordable options for an Oklahoma driver with a clean driving history.

AVERAGE auto INSURANCE RATES WITH A DUI

Alcohol was involved in the deaths of 1,864 people in Oklahoma between 2009-2018, with the state showing higher rates of death by age and gender than the national averages. 1% of drivers in Oklahoma say they have driven after drinking too much within the previous 30 days.

The state takes driving under the influence seriously: those who receive a DUI charge face jail time, fines and license suspension. They also face increased auto insurance quotes, as evidenced by the table above.

DUIs stay on driving records for ten years and incur additional penalties through the DMV’s points-based system. Avoiding getting a DUI is the best way to stay safe and find cheap auto insurance, so think twice before getting behind the wheel after drinking.

Cheapest auto Insurance for Drivers With Tickets in Oklahoma

Any violation, even minor ones like tickets, will increase auto insurance rates in Oklahoma. For example, the average annual rate for drivers with a speeding ticket is $1,657. That is $358 more than the average rate for drivers with a clean record.

The cheapest auto insurance companies for Oklahoma drivers with speeding tickets and full coverage are:

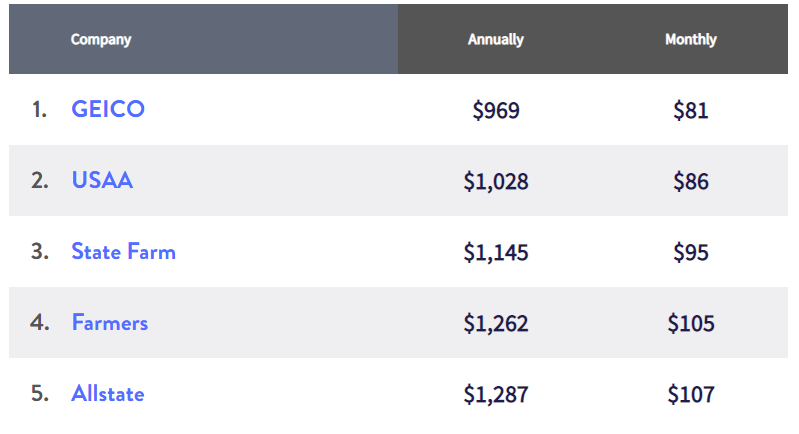

- GEICO: $969 per year

- State Farm: $1,145 per year

For those who qualify for USAA coverage, this company is the second cheapest, with an average annual rate of $1,028 for Oklahoma drivers with tickets.

AVERAGE auto INSURANCE RATES WITH A TICKET

Whether trying to send a quick text, locate a stick of gum, or pick a podcast, all of these activities can endanger you and others around you. Finding cheap auto insurance with a ticket in Oklahoma can also be substantially more difficult. The table above looks at average costs for auto insurance after getting pulled over.

The amount of time a ticket impacts your record depends on whether or not you receive other infringements and if you take a motor vehicle accident prevention course. Oklahoma uses a points-based system and allows drivers to remove two points per 24-month period by engaging in driver improvement or defense classes. Distracted driving can cost more than higher auto insurance, so keep your eyes on the road.